Missing Participants: What Plan Sponsors Need To Know About the DOLS's Latest Guidance

When workers change jobs and relocate, plan sponsors face several challenges, including locating former employees who have left funds in a qualified...

Recently, Congress began to scrutinize the plummeting audit rates of the nation’s wealthy. In 2010, audit rates for those earning more than $5 million annually were 16%. Audit rates for the same population had dropped to just over 2% in 2019.

According to a statement recently released with the agency’s annual Data Book, the Internal Revenue Service (IRS) is taking steps to reverse this trend and will be auditing the tax returns of the highest-earning taxpayers much more aggressively.

In the past seven months, in fact, audit rates for taxpayers in all income categories over $100K have increased. For those whose income fell between $100K and $500K, audit rates have risen to 0.6%, twice that of 2019 audit rates. For those whose annual income exceeded $10 million, audit rates were reported to be 8% - a fourfold increase.

According to information released by the Government Accountability Office, for individuals whose annual earnings were more than $5 million, the 2010 audit rate was 16%. It drastically fell to just over 2% in 2019. This translates into one in six high-income earners being audited in 2010 and falling to one in fifty in 2019.

According to a recent agency report, “Substantially, all experienced field revenue agents are focused on high-income individuals and their related entities.” With reduced funding and a decline in the number of revenue agents, however, there is only so much the IRS can do. The number of revenue agents who conduct in-person audits is currently 8,300. This translates into a 40% decrease over the last decade.

The Treasury Department estimates that the amount of taxes corporations and the highest-earning taxpayers avoid paying annually is equivalent to the total amount of all taxes collected from the lower 90% of taxpayers.

In a statement to Congress, IRS Commissioner Charles Rettig admitted, “We are, quite simply, outgunned.” When compared to 2010 and adjusting for inflation, the Congressional Budget Office reports the IRS has approximately 20,000 fewer employees and 20% less funding.

Due to the agency’s lack of resources, the IRS has leaned heavily on performing audits by mail. This type of audit is easier to perform and is skewed towards the lower tax brackets. Strangely enough, an analysis from the Transactional Records Access Clearinghouse (TRAC) at Syracuse University discovered that individuals earning less than $25K were five times more likely to be audited by the IRS compared to all other tax brackets. This is because returns filed by low-to-moderate earners claiming the earned income tax credit (EITC) typically have higher rates of incorrect payments, leading to a greater need for enforcement. Audits for taxpayers using the EITC are easier to perform than lengthier audits required by the highest-earning taxpayers.

Audit rates for high-income earners have decreased largely because their audits are often complicated and require a manual review of multiple issues. The IRS just doesn’t have the resources or funding to take on more high-income individuals.

Last year, according to a report from the Treasury Inspector General for Tax Administration, the agency’s goal was to hire 5,473 workers, but they were only able to hire 3,660. This year their goal is to hire 10,000 workers, hoping to tackle an enormous backlog of 24 million unprocessed tax returns and correspondence. This substantial backlog has also resulted in audits often falling later in the statutory period, meaning that audits for 2019 may occur as late as 2023 – within three years of filing. Ken Corbin, chief taxpayer experience officer for the agency, admitted that hiring has been a challenge. On June 1st, the agency issued its most recent call for 4,000 more workers.

In February, IRS Commissioner Charles Rettig shared in an op-ed published on Yahoo News, “Without long-term, predictable funding, the IRS will continue to face severe limitations, unable to provide the service taxpayers deserve and need.” In November 2021, President Joe Biden began pushing a proposal for an $80 billion funding boost for the agency’s enforcement capabilities over the next decade. Seven months later, this large-scale effort is still stalled in the Senate.

With the current resource budgetary constraints, personnel shortages, and extensive backlog, the agency will continue to have limited capabilities to audit high-net-worth taxpayers.

When workers change jobs and relocate, plan sponsors face several challenges, including locating former employees who have left funds in a qualified...

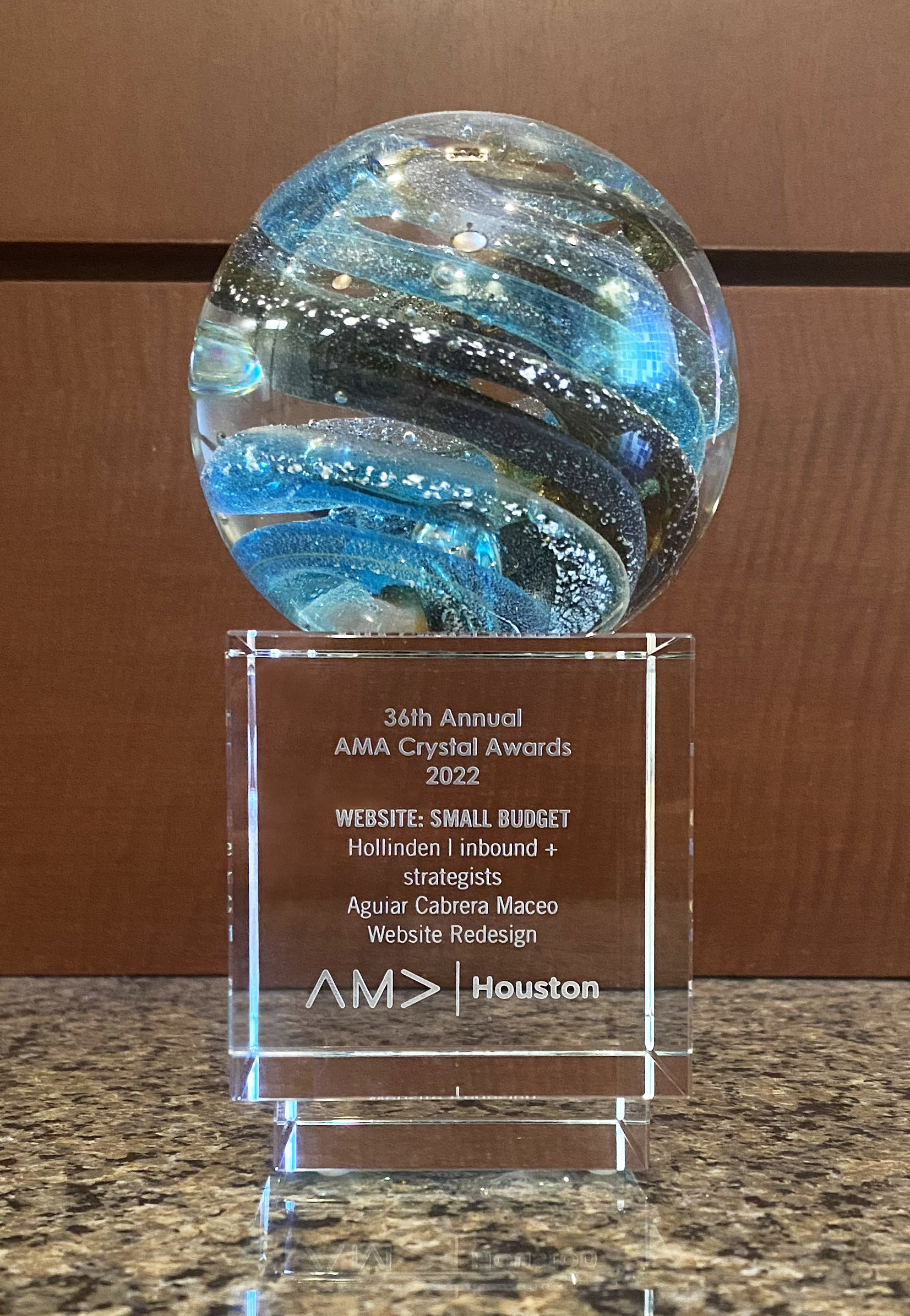

Aguiar Cabrera Maceo Wins American Marketing Association’s Crystal Award for Best Website Redesign: Small Budget

A large portion of the real estate industry in Florida is made up of condo associations with nearly 2 million Florida residents choosing to reside in...